Importing from overseas? You might be owed thousands in tariff refunds.

Our tariff experts analyze your import data and help you recover overpaid tariffs you didn't know you were eligible for.

BACKED BY INDUSTRY STANDARDS

Turn Tariffs Into Opportunity

Recover nearly all your import fees when eligible goods are exported, scrapped, or unused.

You Import

Pay tariffs and duties when your goods enter the U.S.

You Export or Scrap

Send the goods abroad or dispose of them domestically.

U.S. Customs Refund

Claim back up to 99% of those import fees through the federal drawback program.

See How It Works

Our process is simple, transparent, and effective.

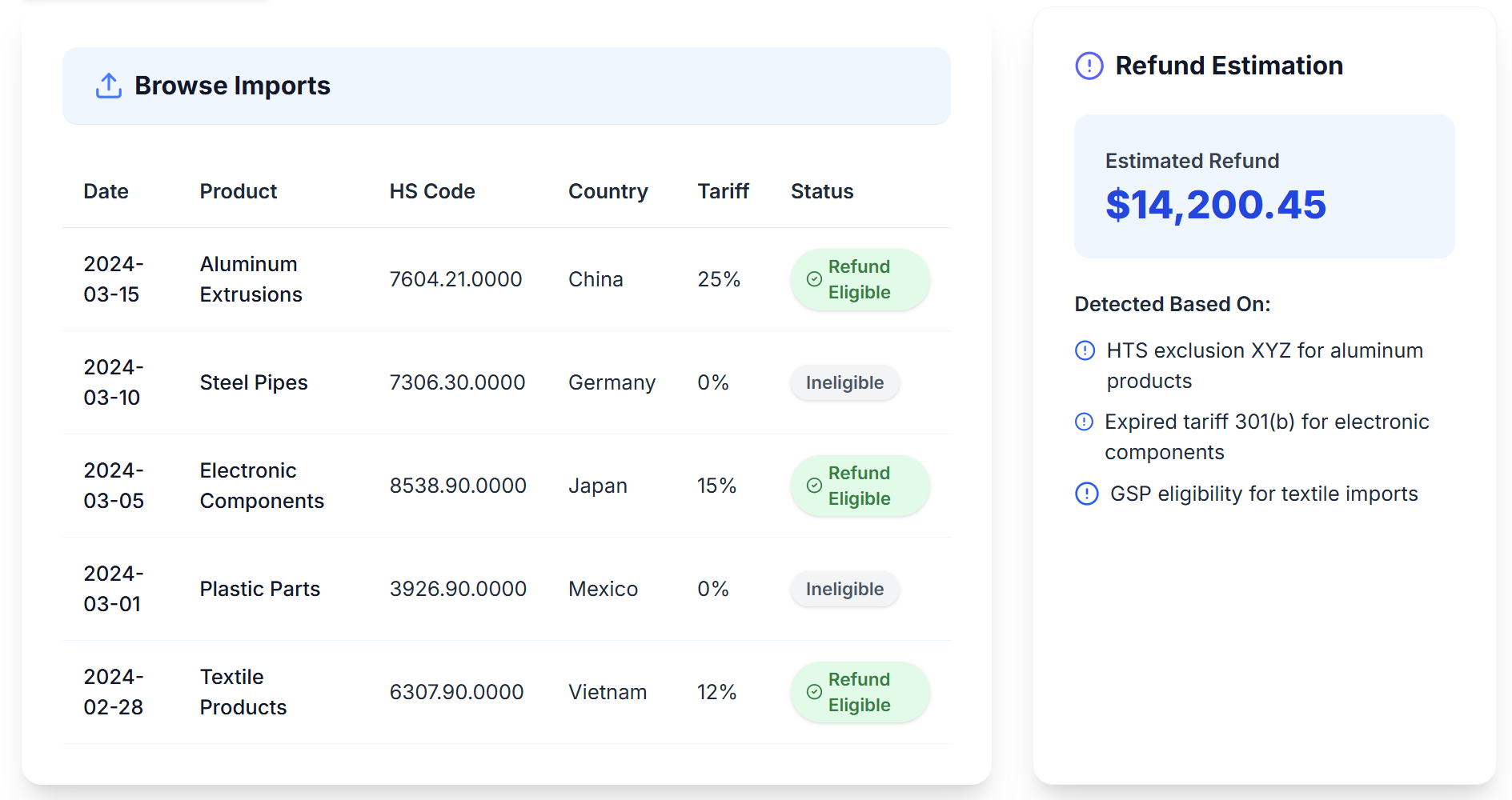

Expert Analysis

Our tariff experts analyze your import data to identify refund opportunities. We look for exclusions, misclassifications, and expired tariffs that may entitle you to refunds.

- ✓Comprehensive review of your import history

- ✓Identification of all potential refund opportunities

- ✓Detailed explanation of findings

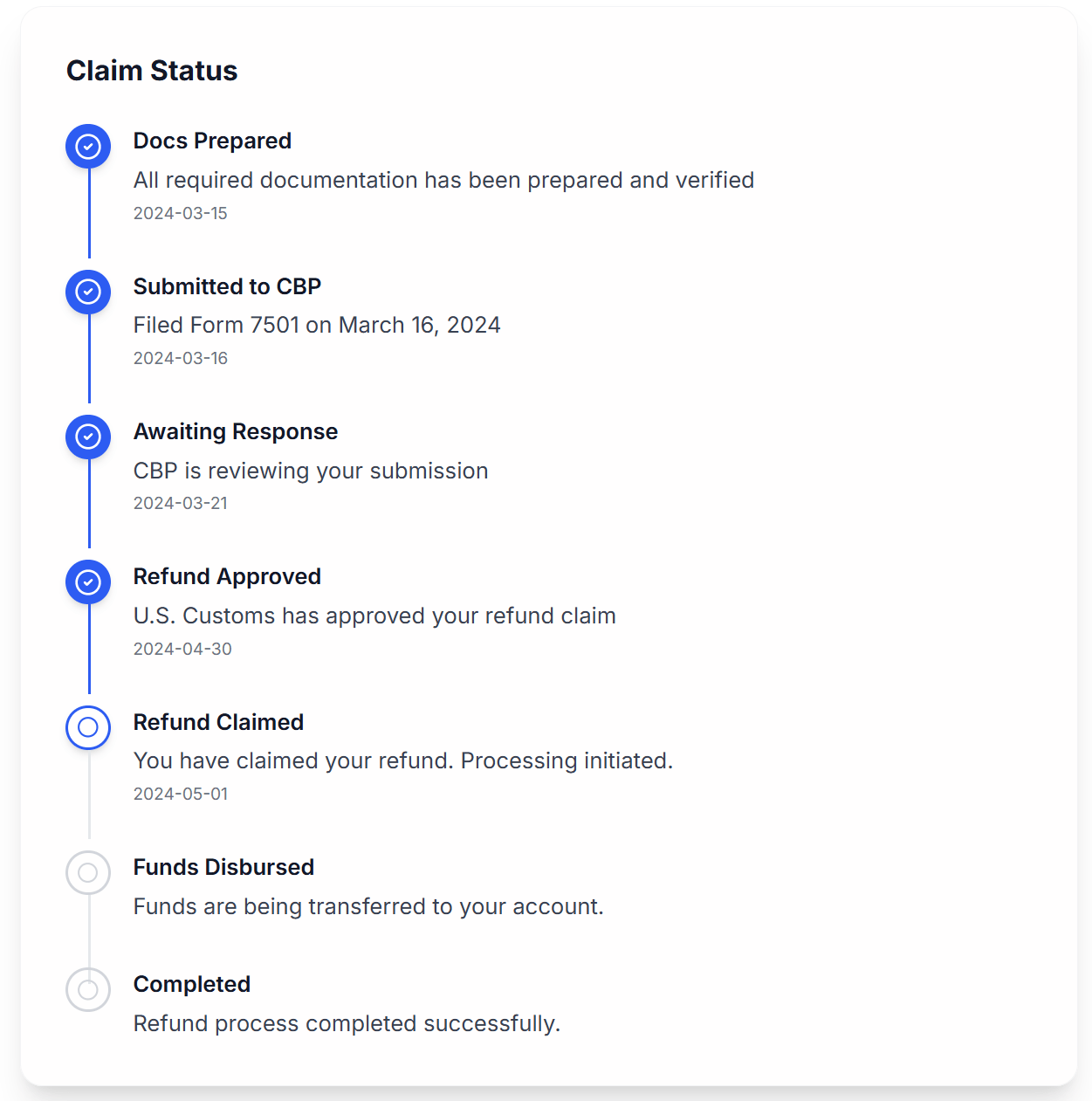

Streamlined Filing

We handle the entire filing process for you, from preparing the necessary documentation to submitting the claims to U.S. Customs and Border Protection.

- ✓Preparation of all required documentation

- ✓Submission of claims to CBP

- ✓Regular updates on claim status

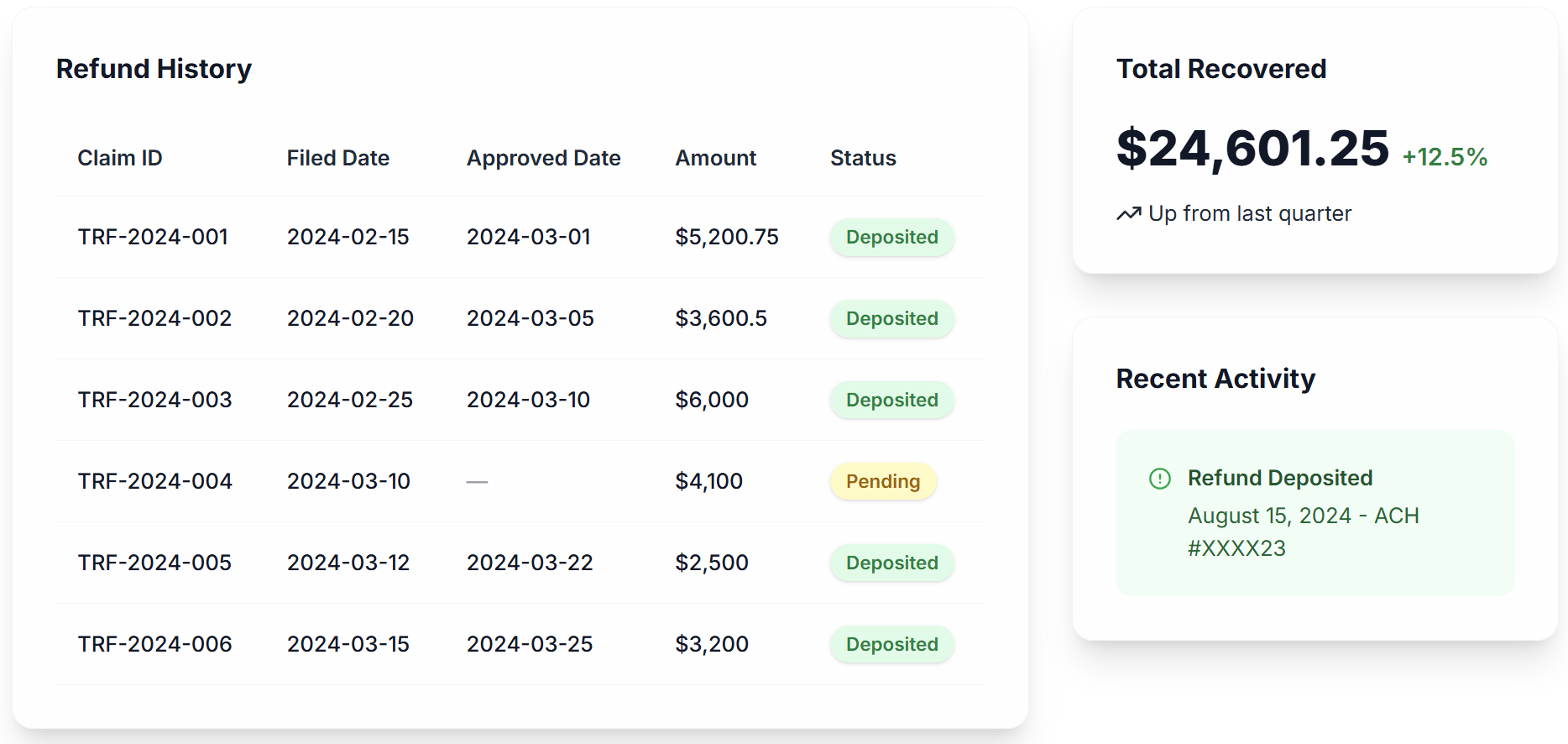

Refund Recovery

Once your claims are approved, we ensure you receive your refunds promptly. Our clients typically see results within 30-90 days.

- ✓Tracking of refund disbursement

- ✓Direct deposit to your account

- ✓Detailed reporting of recovered funds

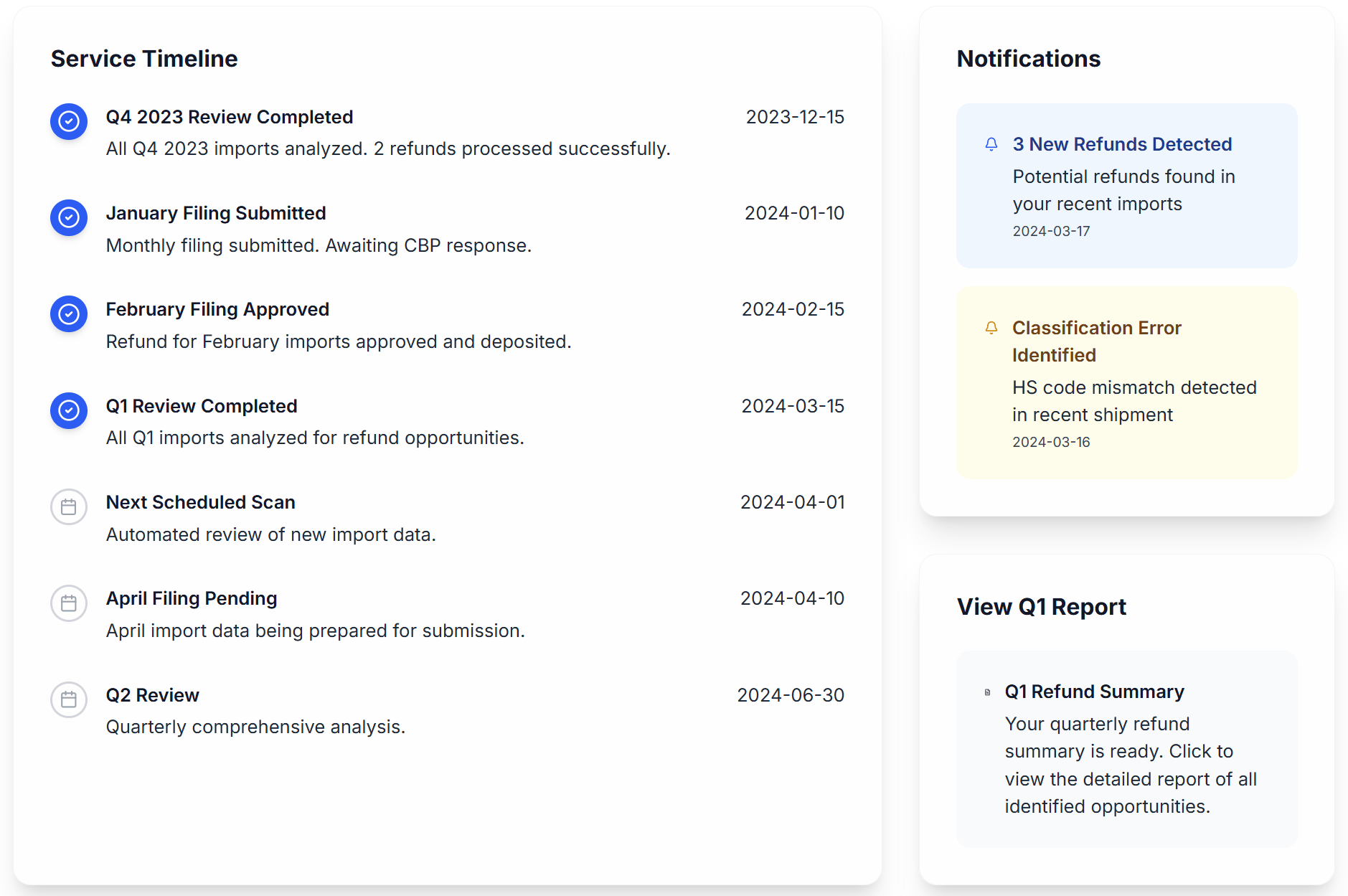

Continuous Filing Service

We don't stop at a single refund. Our continuous filing service monitors your imports on a scheduled basis, automatically identifying new refund opportunities and filing claims on your behalf.

- ✓Regular scheduled reviews of your import data

- ✓Automatic filing for new refund opportunities

- ✓Quarterly reports on refund status and projections

- ✓Proactive monitoring of tariff changes and exclusions

Frequently Asked Questions

Any business that imports goods into the United States may be eligible for tariff refunds. This includes manufacturers, distributors, retailers, and more. If you've paid duties on imported goods, you could potentially qualify for refunds.